Self Assessment Tax Returns Submitted to HMRC

At your initial free meeting we’ll agree a course of action for your Self Assessment Tax Return, whether you’re a self employed sole trader, a partnership, or you’re required to file a tax return for any other reason.

The online filing deadline for tax returns is 31st January following the end of the tax year. The tax year runs 6th April until 5th April the following year.

No surprises

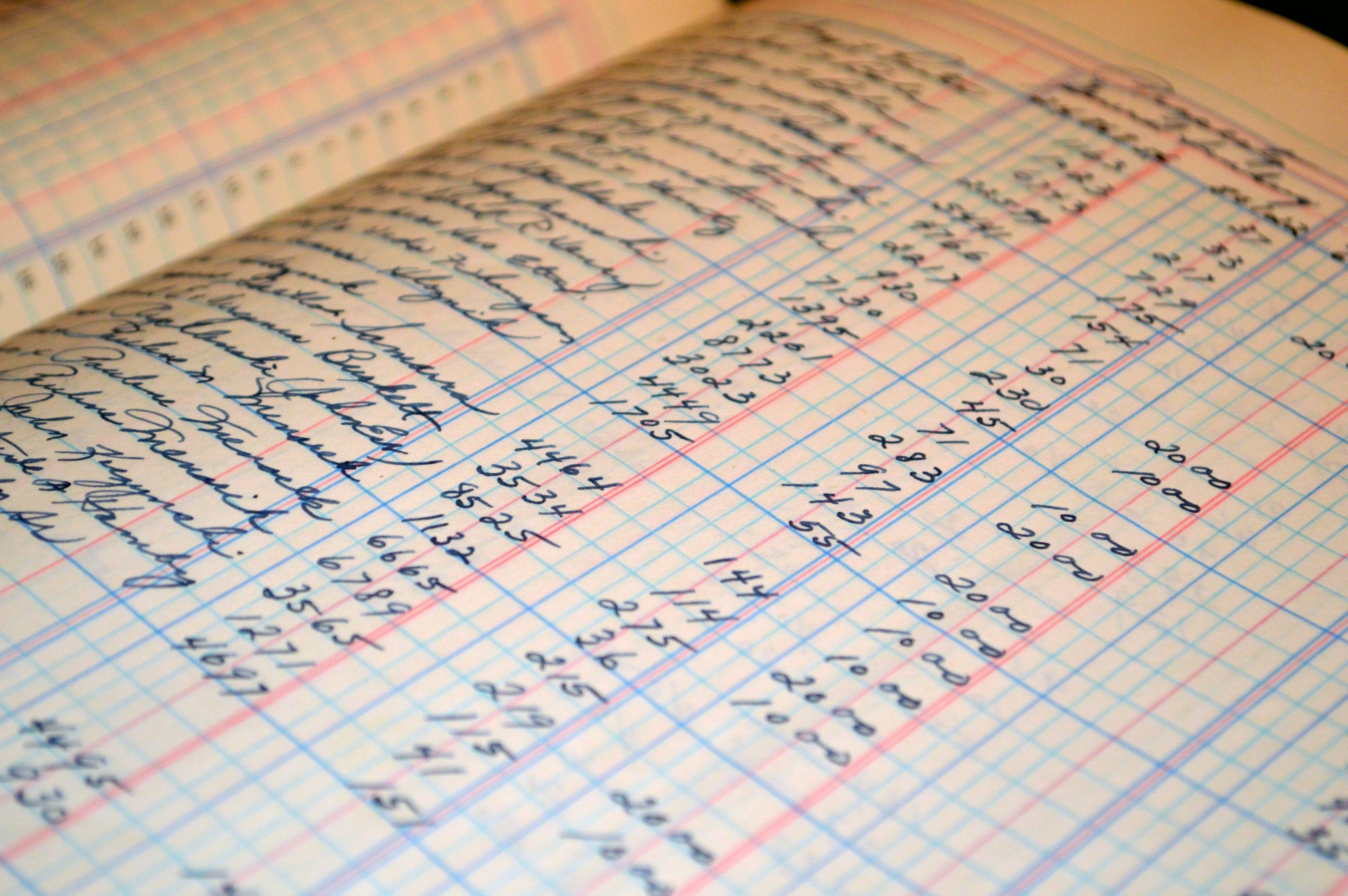

We’ll provide an agreement of services at a fixed price which will be signed by all parties. We’ll be able to make bookkeeping recommendations to you as part of this process.

LMN Accounting will produce accounts and tax returns from the information and explanations provided. You will be advised of any tax liabilities, when they are due and how they should be paid.

Once you have indicated that you are happy by signing the paperwork, and paying the fee, the tax return will be submitted online on your behalf.

Clear advice

Everything will be communicated to you in a clear manner. If you’d like clarification at any point, we’re always available to ask.

Looking for VAT Return, Bookkeeping or Payroll advice?